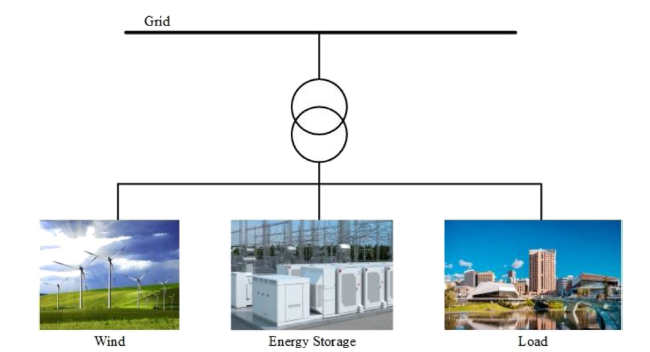

Energy storage in concert with wind energy have become attractive for grid and electricity customers which can increase system stability and efficiency, and moreover facilitate penetration of renewable energy and reduction of their costs [

27,

28]. More complex and general optimization methods and dispatching strategies have been proposed and analyzed aiming to reduce electricity costs. A BESS participating in an electricity market (Spanish Day-Ahead Market) for arbitrage was investigated through a Mixed Integer Linear Programming (MILP) optimization [

17]. The daily price difference is among 5~50€/MWh. The objective of the optimization is to schedule the charging-discharging to maximize revenues of reduce the cost of use. For a 1MW/1MWh BESS system, the annual accumulated profits were about €1000~2100 when the accumulated storage energy was about 400~800MWh [

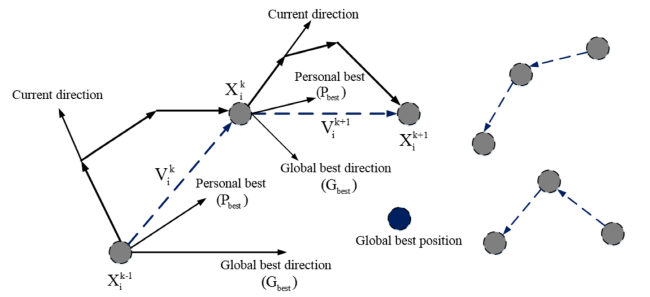

17]. A particle swarm optimization (PSO) algorithm was utilized to figure out the buildings’ optimal operation strategy with renewable energy and battery energy storage system to minimize the cost of energy [

29]. The cost is reduced by 12.1%-58.3% under the proposed operation strategy with various electricity prices [

29]. Electricity cost saving potentials are affected by the size of renewable energy or battery bank. A distributed generation (DG) system with renewable energy (wind turbine, PV) that is connected to the grid is proposed in reference [

30]. Different energy portfolios (PV, PV with government subsidies, PV with Wind generation) and capacity were investigated through an optimization algorithm to reduce the distributed generation lifecycle cost. The analysis showed that exploring wind power can realize cost-savings in locations where the average wind speed was above 4.8 m/s [

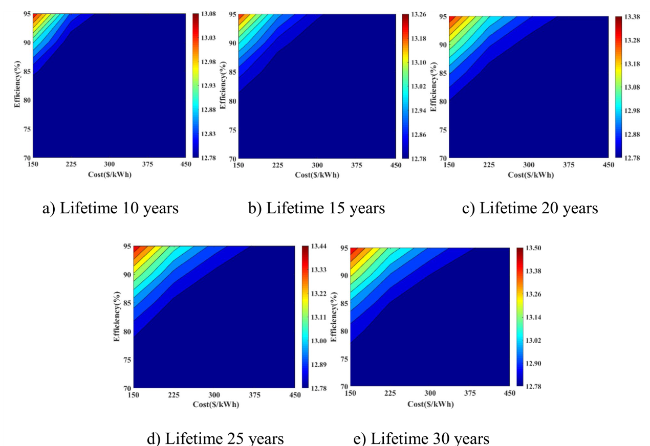

30]. Given the real-time pricing in Spanish electricity market, a grid-connected storage system is modelled to minimize the levelized cost of energy (LCE) by optimizing the size and control of the storage system [

31]. In case of the 2013 Spanish electricity market, the battery storage system was not profitable due to small price difference in a whole day, unless the cost was no more than 0.045 €/kWh in the near future [

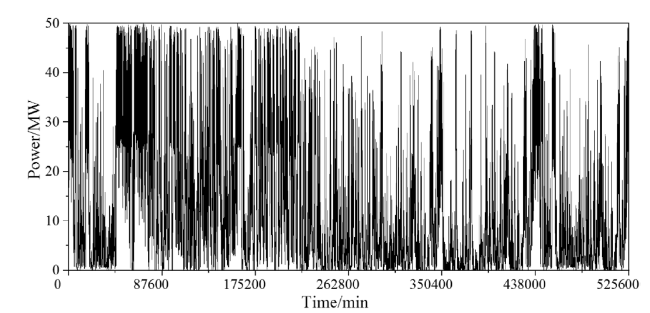

31]. A grid-connected BESS with wind energy was studied on scheduling the storage size to minimize energy cost using a whole year data. For a factory, the electricity cost was decreased by 54% in a day in summer time considering the time-of-use (TOU) price, while it is 0.7% reduction in winter time. And the whole year saving of electricity payment could be as much as 28.1% with optimal schedules [

32]. The above-mentioned research mainly aimed to reduce electricity cost when purchasing electricity from grid. A few publications presented methodology to schedule charging-discharging for maximizing electricity sales under TOU tariff. Sioshansi et al. analyzed the arbitrage revenue of a price-taking storage system with different storage capacities in considering various technologies and applications for PJM electric market in USA [

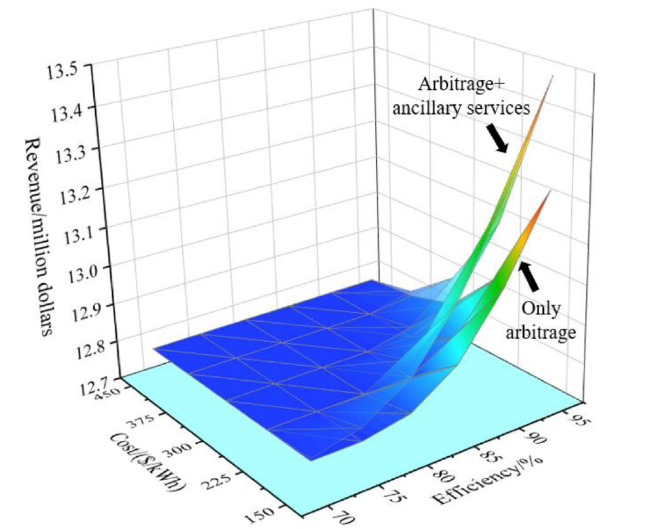

33]. These factors were considered including locations, fuel price, energy storage efficiency and size, and load profile. The arbitrage revenue in PJM with an energy storage roundtrip efficiency of 80% and a storage time of 12 hours can reach \$110/kW-year [

33]. A method of price signal prediction for energy arbitrage scheduling of energy storage plant was developed based on feature selection tools and classification techniques [

34]. A case of arbitrage was studied utilizing the utility-scale Lithium battery that participated in the Ontario wholesale market in Canada. A 5-MW, 1-h Lithium battery with round-trip efficiency of 78% was analyzed. The total profit through arbitrage of the energy storage plant was as much as 78,723 US dollars for 8 months [

34]. An optimal charging scheduling was investigated for electric vehicles (EV) with wind power generation [

35]. Some factors including whether the wind power sufficient, electricity price, SOC of an EV, wind generation pattern were considered. The study revealed an adaptive principle to better install the wind generation among EVs [

35]. As the energy storage system can be at states of charging, discharging, and still storage, it provides spinning reserve service (charging and discharging processes), and non-spinning reserve service (still storage state) [

36]. Energy storage to provide reserve services plays vital role in reducing several uncertainties in the power systems with high shares of renewable sources [

37]. In an IEEE-30 bus test system case study, the energy and spinning reserve requirements are 13.53 GW/day and 1.355 GW/day, respectively. The value of \$2395/day can be saved when energy storage providing spinning reserve service [

38].