1 Introduction

2 Review on storage valuation methods

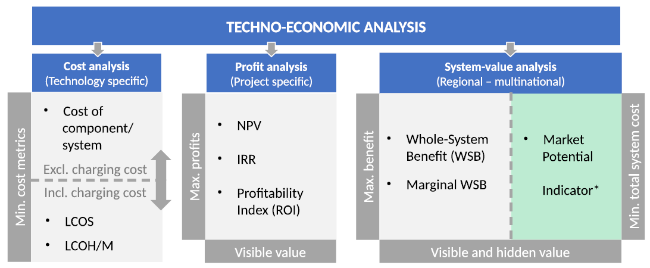

Fig. 1 Classification of current techno-economic analysis methods in the context of energy storage. *Market potential indicator is a suggested decision metric and part of the newly introduced market potential method. The abbreviations mean the following: levelised cost of storage (LCOS), levelised cost of hydrogen or methane (LCOH/M), net present value (NPV), internal rate of return (IRR), return of investment (ROI) |

2.1 Cost analysis

2.2 Profit analysis

2.3 System-value analysis

3 Methodology

3.1 Market potential method

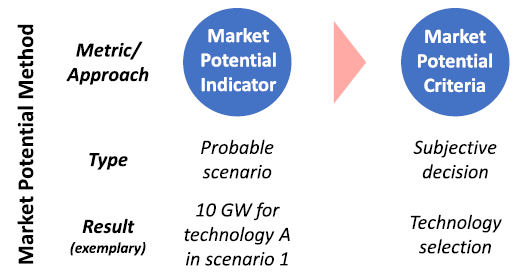

Fig. 2 High-level description of the Market Potential Method. First a market potential indicator is derived for a single or multiple possible scenarios. The market potential indicator is then used by an entity through a market potential criteria to support design-decisions making on energy storage technology |

3.1.1 Market potential indicator

3.1.2 Scenario selection and dealing with uncertainty

3.1.3 Market potential criteria

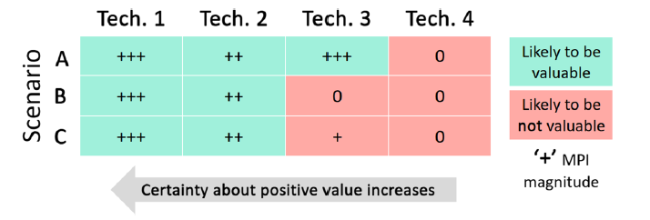

Fig. 3 Qualitative illustration of market potential criteria applied to a set of scenarios and technology options. The “+” indicates the MPI magnitude. Additionally, the threshold rule is set to a single plus, meaning that a company requires at least two plus to consider a technology as a potential candidate to manufacture or start R&D activities |

3.2 PyPSA-Eur. Model structure and data

Table 1 Power related energy storage model inputs representing 2030 data |

| Energy storage components | Electrolysor | Fuel cell | Battery Inverter | ||

|---|---|---|---|---|---|

| LCOS Scenario | [Low] | [High] | [Low] | [High] | [-] |

| Investment [EUR/kWel] | 339 | 677 | 339 | 423b | 209c |

| FOMa [%/year] | 2 | 3 | 2 | 3 | 3 |

| Lifetime [a] | 25 | 15 | 20 | 20 | 10 |

| Efficiency [%] | 68 | 79 | 47 | 58 | 90 |

| Discount Rate [%] | 7 | 7 | 7 | 7 | 7 |

| Based on Ref. | [13] | [13] | [63] | [63, 64] | [64, 65] |

| Alkaline | SOECd | PEMe | SOFCf | Li-Ion Batteryg | |

aFixed operation and maintenance cost as percent of the annualised investment costs bIncludes fuel cell stack replacement after 10 years which cost 30% of initial cost cIncludes 80 EUR/kW balance of plant, mainly assigned to wiring and connection [65] dSolid-Oxide Electrolyser eProton Exchange Membrane or Polymer Electrolyte Membrane fSolid-Oxide Fuel Cell gLithium-Ion Battery |

Table 2 Energy related energy storage model inputs representing 2030 data |

| Energy storage components | H2 storage | Battery storage | |

|---|---|---|---|

| LCOS Scenario | [High] | [Low] | [-] |

| Investment [EUR/kWhel] | 8.4 | 8.4 | 188b |

| FOMa [%/year] | - | - | - |

| Lifetime [a] | 20 | 20 | 10 |

| Efficiency [%] | - | - | - |

| Based on Ref. | [64] | [64] | [65] |

| H2 steel tanks | Li-Ion Battery | ||

aFixed operation and maintenance cost as percent of the annualised investment costs bIncludes 81 EUR/kWh for engineering, procurement and construction costs [65] |

3.3 Energy storage scenarios

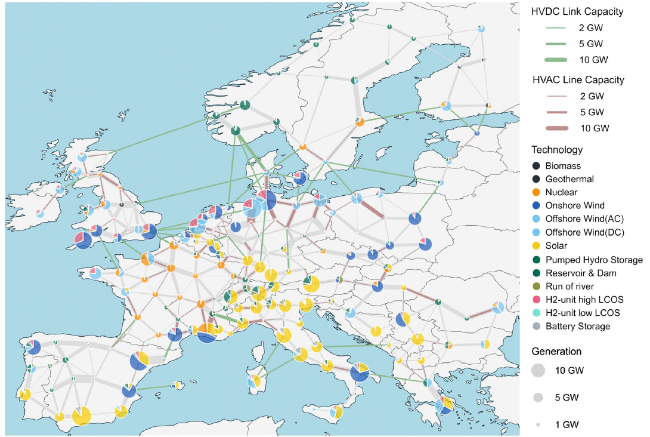

Fig. 4 Optimal generation, storage and network expansion under a 100% emission reduction scenario and technology data for 2030. Light grey lines showing the existing installed network capacity, dark grey lines the additional expanded capacity. Plot produced with PyPSA-Eur |

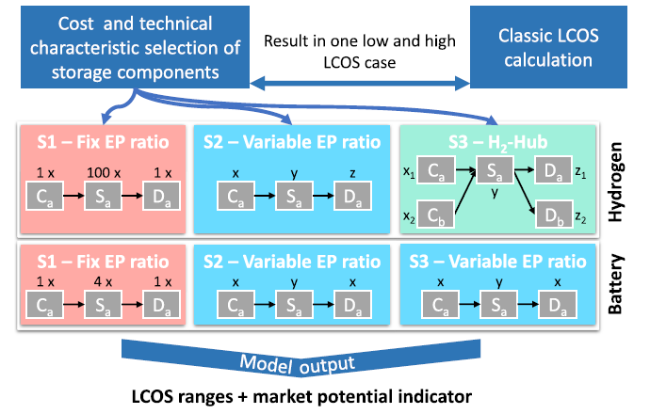

Fig. 5 Description of the three storage scenarios. The cost and technical storage parameters are chosen once and serve as input for all storage scenarios. Scenario 1 shows the fixed energy-to-power ratio of the hydrogen and battery unit a. In Scenario 2 and 3 all components can be freely scaled. However, the battery is constrained to the same charger to discharger ratio. Further, the ’b’ in the H2−Hub scenario indicates a new technology addition. A least-cost optimization is run with each scenarios, whose results are used to create the spatially resolved LCOS and market potential signals |

4 Results and discussion

4.1 Relaxing design constraints of energy storage and its benefits

Table 3 Annual total system costs, relative investment and curtailment data. Variable sizing of energy storage reduces the system costs by 10% |

| Scenario | Total system cost | Relative investmenta | Curtailment [% of annual demand] |

|---|---|---|---|

| Fix EP ratio | 152.9 B€ | 4.874 ct/kWh | 0.61% |

| Var EP ratio | 139.9 B€ | 4.460 ct/kWh | 0.73% |

| H2-hub | 139.7 B€ | 4.453 ct/kWh | 0.37% |

aTotal system cost per annual demand |

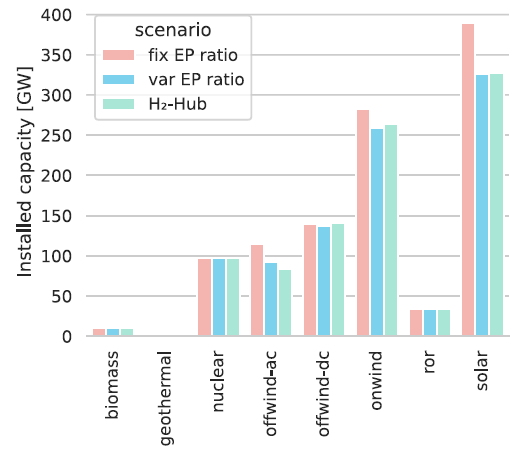

Fig. 6 Optimization result for future installed generation capacity in the exemplary 100% emission reduction scenarios. The abbreviations ’ror’ stands for run of river, offwind-ac and -dc for AC and DC connected offshore wind plants, respectively |

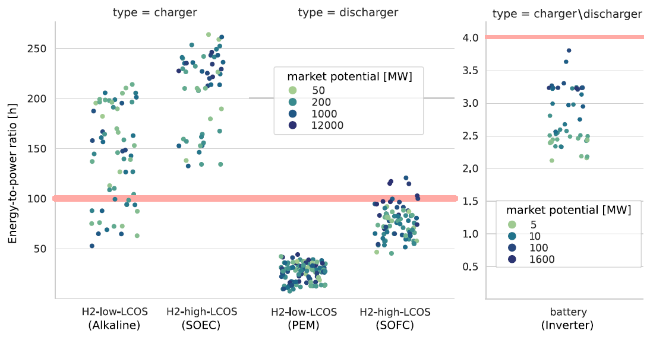

Fig. 7 Optimal energy to power ratio ranges in the variable EP ratio scenario. The red line represents the fixed EP-ratio scenario assumption. The energy to power ratios are very diversely sized in the 181 buses of the cost-optimal European system layout and in regards to hydrogen and not necessarily equal for charger and discharger. The electrolyser capacity is generally smaller than the fuel cell capacity, which means that slow charging and quick discharge at few moments is desired in the system |

4.2 Static LCOS vs modelled LCOS

| Hydrogen storage | Battery storage | ||

|---|---|---|---|

| LCOS scenario | [Low] | [High] | [-] |

| Discharging ratio [h] | 100 | 100 | 4 |

| Electricity price [Eur/MWh] | 50 | 50 | 50 |

| Yearly full load hours [h] | 2500 | 2500 | 3400 |

| Roundtrip efficiencya [%] | 32.0 | 45.8 | 81,0 |

| Lifetime [a] | 25 | 15 | 10 |

| Static LCOSb [ct/kWh] | 0.21 | 0.26 | 0.12 |

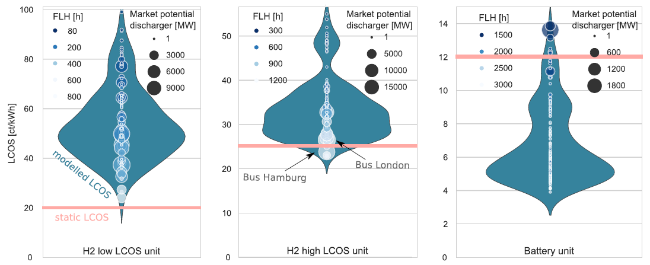

Fig. 8 Static LCOS results compared to European wide modelled LCOS. The static LCOS is marked by a red horizontal line and was calculated for a set of assumption in Table 4. In contrast, the modelled LCOS is given as points and uses spatial-temporal dissolved European energy modelling outputs for its calculation. The size of each point shows the optimised market potential of discharger in a given region and helps indicating the relevance. The colour reveals full load hours for each storage technology and helps understanding the operational behaviour which partially lead to the LCOS. The width of the violin plot shows the occurrence in the kernel density estimation, hence, the wider the plot the more buses are located at the respective LCOS cost range. In all cases, buses with less than 1 MW market potential or 80 FLH are removed, keeping the visualisation readable |

4.3 Market potential method as value indicator

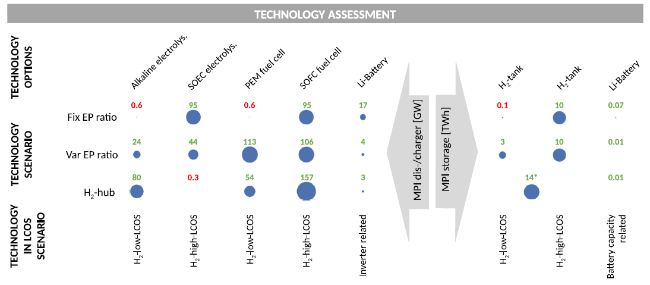

Fig. 9 Market potential indicator for all charging and discharging components in Europe for three technical storage scenarios in a zero emission electricity system. Despite having the same economic and technical input data the market potential vary drastically between the scenarios. The SOFC fuel cell and Li-battery are according to the market potential method, the technologies which are most likely to be valuable in the exemplary set of scenarios. Because they have an optimised market potential indicator in each scenario. *Refers to the total shared storage capacity |

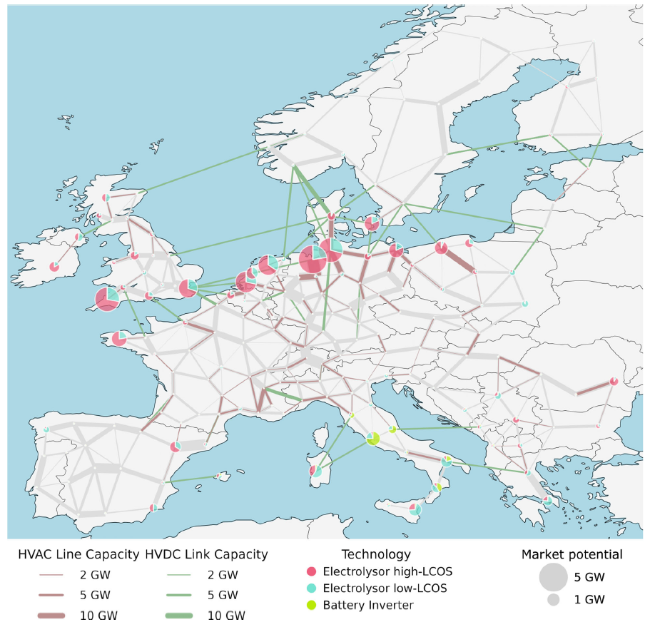

Fig. 10 Optimal energy storage charger distribution in the variable energy to power sizing scenario. Showing the location of market potential in a 100% emission reduction scenario. When compared to Figure 4, most hydrogen units are co-located with wind plants while batteries gravitate towards solar plant optimised areas [68] |